huntsville al sales tax calculator

The Huntsville Sales Tax is collected by the merchant on all qualifying sales made within Huntsville. There is no applicable special tax.

Madison County Sales Tax Department Madison County Al

In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5.

. The Huntsville Alabama sales tax is 900 consisting of 400 Alabama state sales tax and 500 Huntsville local sales taxesThe local sales tax consists of a 050 county sales tax and a 450 city sales tax. Tobacco tax is imposed on the sale or distribution of tobacco products within Huntsville city limits Wholesale Wine Tax Rate A wine tax is levied by the State to be paid directly to the City by wholesale wine dealers. The Huntsville Sales Tax is collected by the merchant on all qualifying sales made within Huntsville.

1-334-844-4706 Toll Free. Within Huntsville there are around 24 zip codes with the most populous zip code being 35810. Whether youre a Huntsville Havoc or a Birmingham Barons fan youre going to get taxes taken out of.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. With local taxes the total sales tax rate is between 5000 and 11500. Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may call ALTIST Certified Auditors Complaint Hotline.

The minimum combined 2022 sales tax rate for Huntsville Alabama is. You can find more tax rates and allowances for Huntsville and Alabama in the 2022 Alabama Tax Tables. This is the total of state county and city sales tax rates.

Overview of Alabama Taxes. The Huntsville Alabama sales tax is 900 consisting of 400 Alabama state sales tax and 500 Huntsville local sales taxesThe local sales tax consists of a 050 county sales tax and a 450 city sales tax. The Alabama sales tax rate is currently.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Sales Tax State Local Sales Tax on Food. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

SmartAssets Alabama paycheck calculator shows your hourly and salary income after federal state and local taxes. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The Huntsville Alabama sales tax is 400 the same as the Alabama state sales tax.

For tax information. Method to calculate west huntsville sales tax in 2021 as we all know there are different sales tax rates from state to city. Did South Dakota v.

Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Huntsville collects a 5 local sales tax the maximum local sales tax.

Avalara provides supported pre-built integration. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Huntsville AL. As far as sales tax goes the zip code with the highest sales tax is 35801 and the zip code with the lowest sales tax is 35808.

You can print a 9 sales tax table here. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The minimum combined 2022 sales tax rate for Huntsville Alabama is.

Method to calculate Huntsville sales tax in 2021. Alabama AL Sales Tax Rates by City H The state sales tax rate in Alabama is 4000. Alabama has income taxes that range from 2 up to 5 slightly below the national average.

In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Method to calculate West Huntsville sales tax in 2021.

ICalculator US Excellent Free Online Calculators for Personal and Business use. While Alabama law allows municipalities to collect a local option sales tax of up to 3 Huntsville does not currently collect a local sales tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Select the Alabama city from the list of cities starting with H below to see its current sales tax rate. For tax rates in other cities see Alabama. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Sales Tax Calculator Sales Tax Table. The current total local sales tax rate in Huntsville AL is 9000.

What is the sales tax rate in Huntsville Alabama. Start filing your tax return now. Sales Tax State Local Sales Tax on Food.

Alabama has recent rate changes Thu Jul 01 2021. The 9 sales tax rate in Huntsville consists of 4 Alabama state sales tax 05 Madison County sales tax and 45 Huntsville tax. A full list of locations can be found below.

The December 2020 total local sales tax rate was also 9000. Real property tax on median home. The Sales tax rates may differ depending on the type of purchase.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Huntsville is located within Madison County Alabama. The Sales tax rates may differ depending on the type of purchase.

You can use our Alabama Sales Tax Calculator to look up sales tax rates in Alabama by address zip code. Your household income location filing status and number of personal exemptions. Interactive Tax Map Unlimited Use.

Alabama has a 4 statewide sales tax rate but also has 350 local tax jurisdictions including. Real property tax on median home. You can use our Alabama Sales Tax Calculator to look up sales tax rates in Alabama by address zip code.

Huntsville in Alabama has a tax rate of 9 for 2022 this includes the Alabama Sales Tax Rate of 4 and Local Sales Tax Rates in Huntsville totaling 5. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Huntsville AL. The Huntsville Alabama Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Huntsville Alabama in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Huntsville Alabama.

The Huntsville sales tax rate is. The County sales tax rate is. The sales tax jurisdiction name is Madison which may refer to a local government division.

Sales Taxes In The United States Wikiwand

Different Types Of Calculators And How To Choose

Pdeliterealty Posted To Instagram Getting A Legitimate Lender And Getting Pre Approved Homeinspection Realtor Realesta Lender Mortgage Lenders Home Buying

Alabama Sales Tax Calculator Reverse Sales Dremployee

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Utah Property Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Alabama Income Tax Calculator Smartasset

Is Food Taxable In Alabama Taxjar

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Alabama Sales Tax Guide And Calculator 2022 Taxjar

Alabama Sales Tax Rates By City County 2022

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Alabama Sales Use Tax Guide Avalara

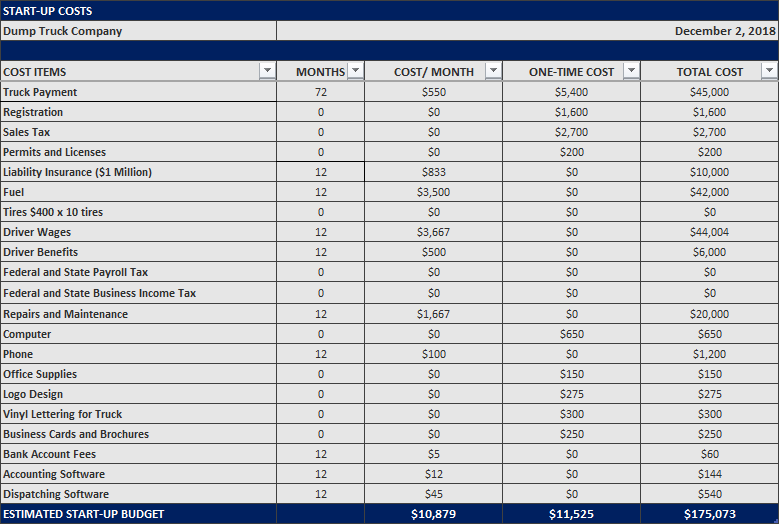

Calculating The Cost Of Starting A Dump Truck Hauling Company