will the salt tax be repealed

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. The Tax Foundation predicts that a full repeal of the.

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000.

. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. At the time they were weighing in on. If the cap were.

All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent. The United States Supreme Court rejected New Jersey and other states requests to restore the full income tax deduction for state and local taxes. A key Democratic lawmaker said a detailed final agreement to restore the federal deduction for state and local taxes could be reached this week with another advocate flagging.

The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is nixed. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. When SALT is repealed the taxes will be going down What he really means is if the cap is lifted overall state and federal taxes will be less for some taxpayers than if its not.

The SALT deduction benefits only a shrinking minority of taxpayers. The so-called SALT tax cap imposed a 10000 limit on IRS deductions for state and local taxes like income and capital gains levies and property taxes. A bill from House Ways and Means Chairman Richard Neal and others would modify and then repeal for two years the 2017 tax laws cap on the federal deduction for state.

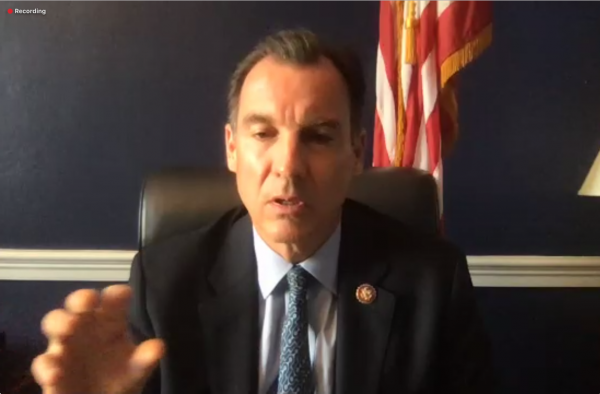

Josh Gottheimer D-NJ Tom Suozzi D-NY. And Mikie Sherrill D-N-J in a joint statement in January. No SALT no deal said Reps.

We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states. Even so the proposal is a victory for the caucus of 30. The Tax Policy Center estimates that in order to repeal SALT in full the cost would be more like 460 billion over the same five years.

House Panel Votes To Temporarily Repeal Salt Deduction Cap The Hill

1806 Thomas Jefferson Abolishing The Impost On Salt Tax Cuts For The Poor State Of The Union History

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Suozzi Meeks Want Salt Cap Repealed Qchron Com

Counties Call For Repeal Of Salt Cap Westside News Inc

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

House Democrats Concede Line In Sand Over Ending Salt Cap Politico

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 1 75 Trillion Social Spending Bill Marketwatch

Bill Schmick The Retired Investor Will Salt Be Repealed Columnists Berkshireeagle Com

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

Democrats Salt Headache Hangs Over Budget Reconciliation Bill Roll Call

Suozzi Will Not Vote On Tax Code Changes Until Salt Deduction Cap Is Repealed Great Neck News The Island Now

Salt Tax Repealed By House Democrats The Washington Post

Tax The Rich Maybe Not Democrats Spending Plan Could Be A Tax Cut For The Rich Budget Watchdog Finds Cnn

Porter Backed Bill Seeks To Restore Salt Deductions Capped Under 2017 Tax Act Orange County Register

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Will Biden Repeal Gop S Tax Change That Reduced His Deductions By 352 000 The Motley Fool